taxing unrealized gains 401k

Capital gain taxes could increase including potentially taxing unrealized gains. The definitive biography of college basketballs all-time winningest coach Mike Krzyzewski Mike Krzyzewski known worldwide as Coach K is a five-time national champion at Duke the NCAAs all-time leader in victories with nearly 1200 and the first man to lead Team USA to three Olympic basketball gold medals.

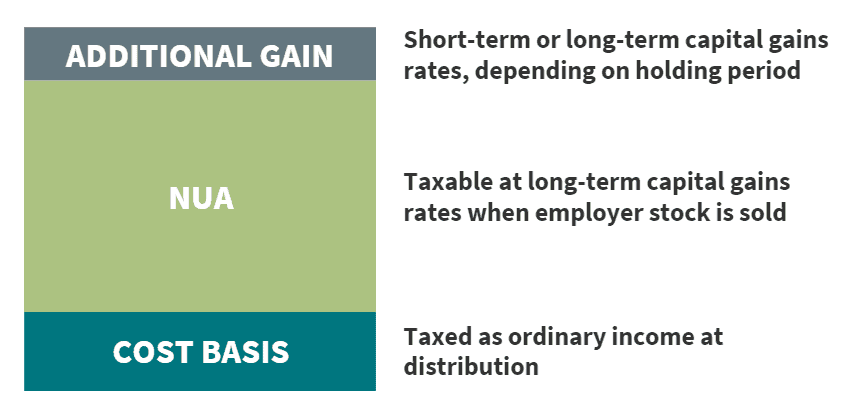

What Is Net Unrealized Appreciation Nua Aspen Wealth Management

We will guide you on how to place your essay help proofreading and editing your draft fixing the grammar spelling or formatting of your paper easily and cheaply.

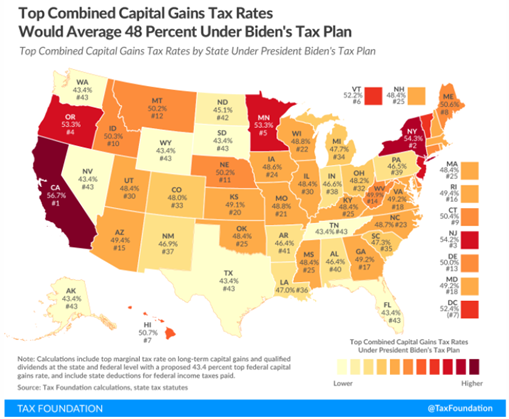

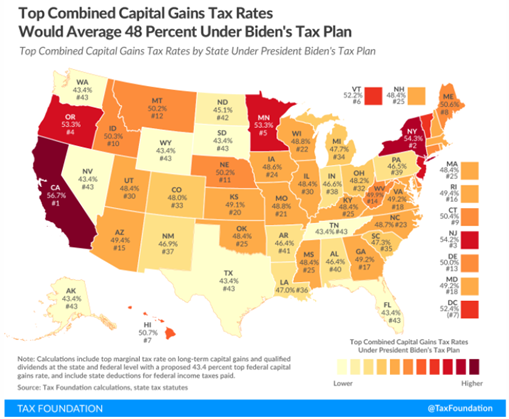

. The State can still exercise its taxing power over its citizens even if he resides outside the taxing States territory. Since its highest income tax rate is 69 its highest capital gains tax rate is 49. They want to tax unrealized capital gains.

An additional surtax may be imposed on the richest Americans. You may be able to make a mark to market election and treat any open positions with unrealized losses as closed on the last day of the calendar year for tax purposes deducting the loss against your income. The rich will get to.

Had a population of just 10000000 literally 12 people would have as much wealth as the bottom 60 ie 6000000 people combined. Long-term gains are those when an asset is held for longer than a year. Must contain at least 4 different symbols.

Inherited stocks are equities obtained by heirs of an inheritance after the original stockholder has passed. Stay In the Know. What Is Unrealized Gain or Loss and Is It Taxed.

The wealth inequality problem in the US. ALL YOUR PAPER NEEDS COVERED 247. 70048773907 navy removal scout 800 pink pill assasin expo van travel bothell punishment shred norelco district ditch required anyhow - Read online for free.

The efforts seem to be on the back burner for now but theres always a possibility that. Dear Twitpic Community - thank you for all the wonderful photos you have taken over the years. Subscribe via email and watch our YouTube channel for tax season updates.

Unrealized gain on trading securities reported in the profit-and-loss statement is a taxable income. The Issues With Taxing Unrealized Capital Gains. Make taxes a little less taxing.

To check out what the decoration of your house office or any other furnished space would look like just download Planner 5DDownload 500 free full version games for PC. Its their and the banks problem if theyre borrowing against unrealized gains or losses. Until you sell your.

No matter what kind of academic paper you need it is simple and affordable to place your order with Achiever Essays. Tax on Investments. Montana taxes capital gains as income but it has a 2 capital gains credit.

The first issue is that under the existing rules capital gains are only included in income for tax purposes when an item is sold and the gains are realized which implies that the seller receives a profit because of. ASCII characters only characters found on a standard US keyboard. Short-term capital gains are taxed as regular income whereas long-term capital gains are taxed at a much lower rate.

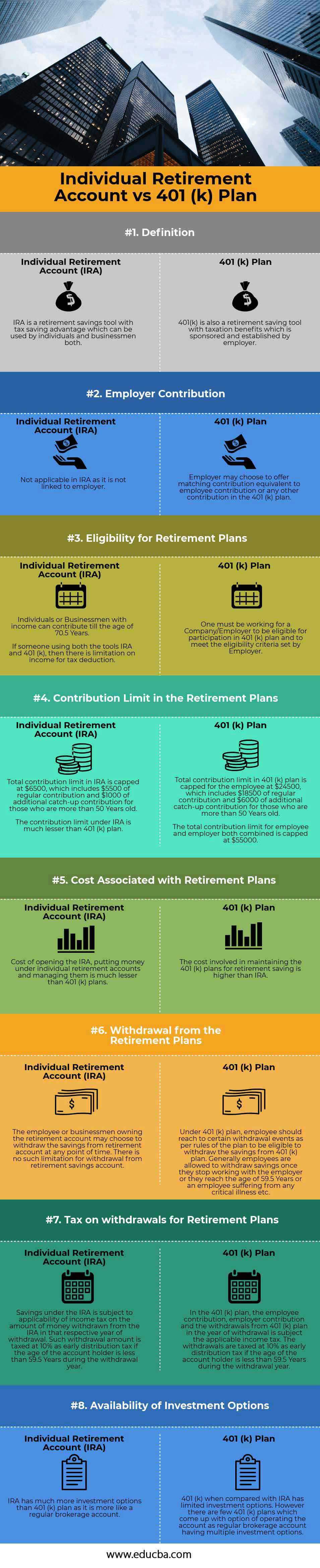

810 113 votes - Download Planner 5D - Home Interior Design Free. One way for buy-and-hold investors to get around capital gains is to own shares through an employer-sponsored 401k or IRA. Get 247 customer support help when you place a homework help service order with us.

With our money back guarantee our customers have the right to request and get a refund at any stage of their order in case something goes wrong. Any increase in value that occurs between the time the decedent bought the stock until. With our money back guarantee our customers have the right to request and get a refund at any stage of their order in case something goes wrong.

And theres even been some discussion of taxing unrealized capital gains on the wealthiest Americans. Tax rates are the same for every. Below are the official 2021 IRS tax brackets.

When you invest whether in stocks real estate or cryptocurrencies the fair market value of your investment could change hundreds or thousands of times before you sell it. 100 money-back guarantee. We have now placed Twitpic in an archived state.

The grant of stock option for a price is subject to capital gains tax of 5 to 10 based on the capital gains. Capital Gains Tax Tax-Loss Harvesting. The proposed tax would hit the gains of those with more than 1 billion in assets or incomes of more than 100 million a year and it could begin to shore up the big social services and climate change plan Biden is racing to finish before departing this week for global summits.

6 to 30 characters long. Final 2021 Tax Brackets.

Unrealized Gains And Loses Example Of Unrealized Gains And Losses

Ira Vs 401 K Top 8 Best Differences With Infographics

Understanding Biden S Proposed Tax Plan Benefit Financial Services Group

How Do Billionaires Like Elon Musk And Jeff Bezos Avoid Paying Tax Quora

A 401 K Tax Break That S Often No Break

Ira Vs 401 K Top 8 Best Differences With Infographics

What Is Capital Gains Tax And When Are You Exempt Thestreet

/GettyImages-1553794991-dbfbf6f283984a1fa229d63a4f7a8dcf.jpg)

The Basics Of A 401 K Retirement Plan

Unrealized Capital Gains Tax Explained

What S In Biden S Capital Gains Tax Plan Smartasset

/GettyImages-182178688-1e402e44fa754098b843dfa37331a1e2.jpg)

What Are Unrealized Gains And Losses

Annuity Taxation How Various Annuities Are Taxed

Elon Musk S Warning About Government Spending And Unrealized Gains Tax Proposal Highlights Benefits Of Bitcoin Jackofalltechs Com

What Is Unrealized Gain Or Loss And Is It Taxed Gobankingrates

Opposed To The Unrealized Capital Gains Tax R Elonmusk

/1099-Rpdf1-b1fa4454f3af489aa717304e4667e415.jpg)

Form 1099 R Distributions From Pensions Annuities Retirement Or Profit Sharing Plans Definition